Steve Keen’s scholarly and public work meticulously exposing the theoretical failings of mainstream neoclassical economics is unmatched in the field, which makes his dismissal of Karl Marx’s contributions to the field much more suspect.

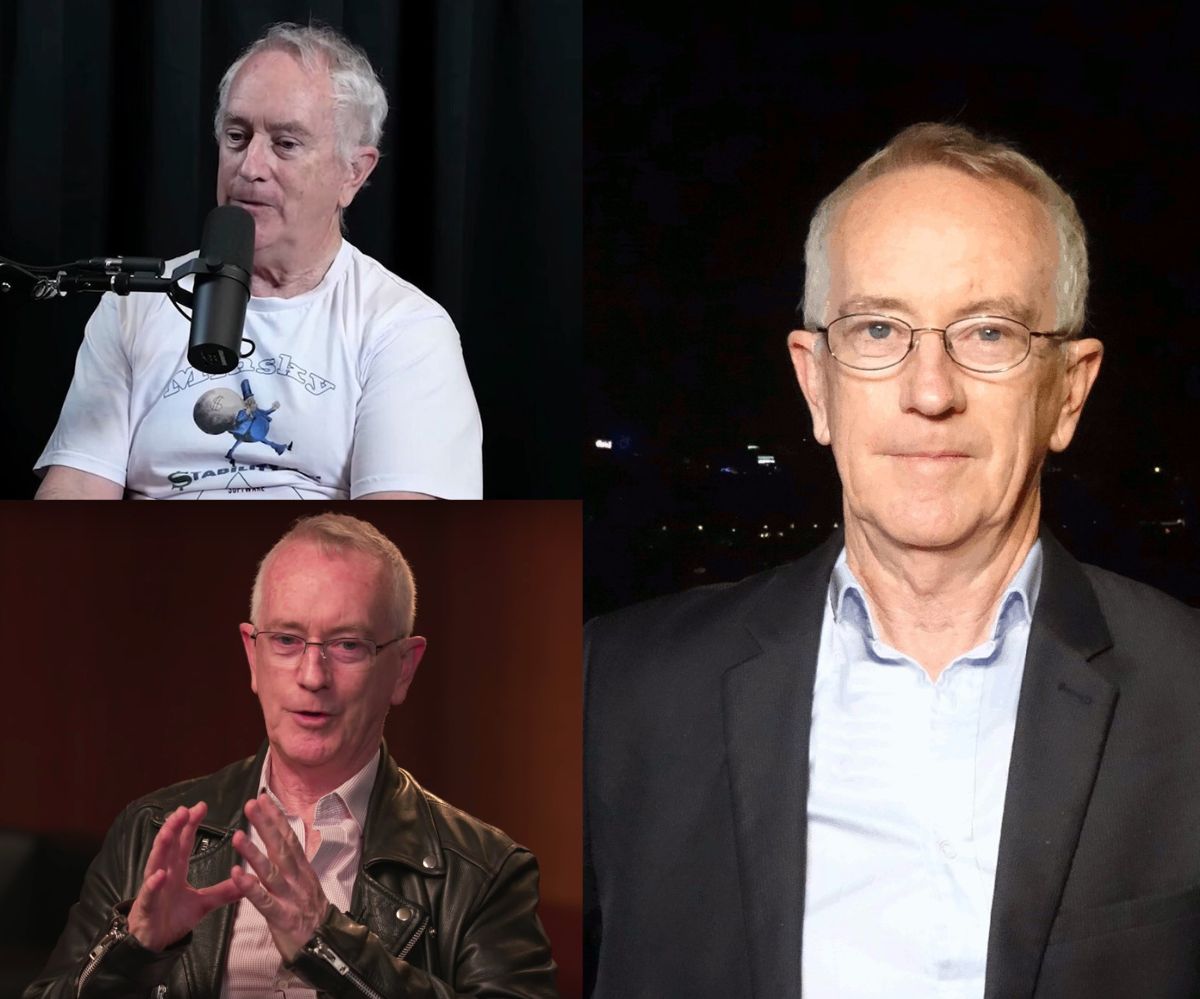

Australian heterodox economist and author Steve Keen has built a relatively large online grassroots following — touting over 10,000 subscribers on his Substack — through his scholarly mission of reforming mainstream economics.

Keen is one of the few economists working today who has reached the public spotlight as an avowed opponent of today’s hegemonic school of economics, the neoclassical school — a school of thought in the discipline that emerged in the late 19th century and came to produce world-renowned figures such as Milton Friedman in the post-WWII 20th century. Since its inception, neoclassical thinking has come to dominate mainstream economic thought in and outside academia all around the world.

Keen’s first book Debunking Economics put him on the map in 2001 as a sharp critic and practitioner of economic theory, with his targets mostly set on neoclassical theory in the debut. Keen then began to seriously draw media eyes his way when he was one of the few economists who predicted The Great Recession in 2007/8.

Throughout his 60s and now into his early 70s, Keen continues to convincingly pleading his case for scrapping the whole of neoclassical theory’s foundations, chief among them being: (I) that unimpeded capitalism reaches a state of “equilibrium”; (II) that private banks, private debt and money needn’t be considered in economic models; and (III) that only the government creates money, not banks as well, which the empirical record shows is patently false.

Beyond his work undermining core mainstream economic assumptions, perhaps his greatest novel contribution to the field is his emphasis on using systems dynamics to model economic interactions. Keen argues that differential equations are far better equipped to model something as complex as a whole economy than the simple difference equations that are ubiquitous in neoclassical modelling.

In recent times, Keen has made his Luther-esque reformist case on notable shows such as BBC’s HardTalk and, more recently, the massively popular Lex Fridman podcast on YouTube.

When one listens to and reads Keen, there’s a sense that his deep knowledge of the history of economic theory and his passionate crusade against neoclassical assumptions comes from a place of genuine worry about the harm that mainstream economics is causing to the planet and our personal lives. This is especially palpable in a chapter of one of Keen’s more recent books, The New Economics: A Manifesto, wherein Keen surveys the complete ineptitude of neoclassical work on climate change, demonstrating that the models used in this work often ignore crucial “tipping-point” variables which leads the neoclassical economists who use by them to often conclude that climate change will be negligible to the economy in both the short and long run.

One such tipping-point variable that’s ignored by these models, Keen demonstrates in the fourth chapter of the book, is that if average temperature in a region reaches 35 degrees Celsius combined with enough humidity, the human body becomes unable to dispel of the internal heat we create in our bodies. This combination can therefore easily lead to death if dry and cool shelter is not readily available.

Despite this, a major survey paper that interviewed 18, mostly neoclassical respondents, found consensus that a three degrees Celsius rise in the Earth’s average global temperature by 2090 would only cause a 3.6 per cent fall in global GDPs. Such an inconsequential figure is simply incommensurate with the fact that most human beings on earth live near the zones that will have tens and even hundreds of deadly days given the imminent temperature increase predictions of scientists as these areas will surpass the climate and temperature threshold needed for the human body to cool itself down.

Add on that many of the nations affected in this way are closer to the equator and are poorer, therefore lacking proper air conditioning compared to the richer Global North, and that much of global manufacturing takes place in said equator-straddling nations, and then the prediction of a 3.6 per cent reduction in GDP by 2090 becomes a laughable conclusion.

However, the ignoring of tipping points like these does in fact lead these often well-decorated, climate-focused neoclassical scholars — including Nobel Prize-winning economist William Nordhaus, a common whipping boy of Keen’s and the one who produced the above-mentioned survey paper — to not see climate change as something to worry about when it comes to impacting our systems of production and distribution of goods and services in the long run.

The likely culprit for why Keen has so much integrity when it comes to approaching issues like climate change from an economics standpoint is that he approaches his field with the rigour of any self-identifying scientist: just because economics is a social science, he would seemingly say, doesn’t mean it shouldn’t be placed under the same intellectual pressures for complex analysis that the natural sciences are. To this end, Keen emphasizes that economics should constantly be updating its base assumptions and the complexity of its object analysis, which again is standard practice in most major scientific fields.

To this end, Keen’s favourite historical analogy for what he sees today’s economics needing is that of the Copernican revolution in astronomy where, in the 16th century, the once mainstream Ptolemaic geocentric belief that the sun rotated around the Earth was challenged by the Renaissance polymath Nicolaus Copernicus who argued it was the other way around, offering a heliocentric model as the more likely truth of the matter.

Copernicus’ argument notably deemphasized Earth’s place in the universe to such a blasphemous degree in the eyes of the ruling feudal elites of the time that when Galileo made observations corroborating heliocentrism in respect to the Earth’s rotation with his telescope in the 17th century, he was promptly prosecuted by the Roman Catholic Inquisition as the former geocentric theory of Ptolemy satisfied Biblical cosmological conceptions.

Nested in the Copernican drama, then, is the idea that the rebutting of a theory that is only internally consistent and therefore bears little relation to reality despite its subject being of the concrete world, can be painful to humanity’s collective ego. This is especially the case if said theory claims to prove some utopic qualities of humanity — say, that we naturally make perfectly rational decisions (wink wink). But this anthropocentric idealism is part of a deep assumption about capitalism made in neoclassical microeconomic theory. Called Homo Economicus, this assumption suggests that with capitalism human beings have finally found an economic system that reaches a rationality-caused “equilibrium” through human agents maximizing their individual and collective utility through perfectly rational decision-making based on narrowly self-interested opportunity-cost analyses when engaging in market interactions, though it tends to become a general ontological theory of all human action and thought.

Being Copernican-esque in respect to this assumption, a central component of Keen’s critical analysis of mainstream neoclassical economics, taking his cue from the instability cycles theory from another maverick economist named Hyman Minsky — and, I should add, agreeing with many Marxists as well — is his argument that in capitalism it’s actually disequilibria that’s the norm.

Therefore, given that private debt — another thing Keen is quick to point out that neoclassicals ignore — is a main driver of recessions when it passes a certain level, governments should be gearing policy towards certain pre-set private-debt-to-GDP ratios with private debt jubilees being on the table as a last resort if private debt levels get too high. This approach fiscal and monetary policy would be a sharp contrast to the failed neoliberal supply-side policy — influenced heavily by neoclassical thinking that ignores private debt as causative to depressions — for dealing with recessions known as quantitative easing, an economic policy that involves selling government bonds to central banks to stimulate the economy, but which historically has the effect of bailing out the private banks and firms that created the debt bubble in the first place while laying the groundwork for the next private debt bubble.

Keen’s understanding of the dangers of unregulated financial institutions creating disastrous private debt levels, alongside his warmth to modern monetary theory and its refutation of the loanable funds model of private bank lending, certainly influences his politics, which could be described as entailing a preference for a uniquely technocratic social democracy.

With all that being said, Keen is expressly pro-capitalism, saying as much during his 2016 HardTalk appearance.

And his lingering commitment to the capitalist system overall is precisely where Keen’s weaknesses in terms of critical analysis of the economy starts to expose itself.

A primary issue in this respect, is how Keen’s big-picture definition of capitalism injects an idealistic innovative entrepreneurialism into it, arguing that entrepreneurial innovation is not only integral to capitalism, but the key strength of the system (see Maria Mazzucato’s The Entrepreneurial State for a book-length debunk of the latter notion).

One should note right away that the Marxist definition of capitalism proper is simply that it’s a system where the means of production (i.e. capital) in society is largely privately owned, and while Marx did acknowledge that this system and its inherent competitive feature makes capitalism a highly productive-intensive system, that meant little about its ability to harness innovation to serve the needs of human society.

Keen’s more idealistic political-economic views vis-à-vis capitalism, then, causes him to erroneously see many of the malicious outgrowths from capitalism’s inherent class contradictions as exogenous to capitalism, given the incentive systems of his ideal of a “good” capitalism wouldn’t allow for them.

And what Keen’s ideal capitalism would entail is essentially a political-economic order where governments that have been enlightened by modern monetary theory’s debunking of the deficit myth, and who have also acknowledged the above-mentioned faults of neoclassical theory, would resultantly go on to run productive deficits while empowering innovative firms by regulating the banks away from risky debt-based investing.

While this story sounds nice and would be vastly better than the austerity and unregulated corporate malpractice engendered by current-day neoliberal policy, it ignores relatively recent history that suggests this system can’t be durable in the long run.

The FDR-New Deal revolution in the U.S. saw a government that ran productive deficits and regulated private banks and private industry this way for a good part of the 20th century. By the 1970s, however, the sheer existence of capital as a consolidated class with specific class interests that ran directly against the public good saw the almost full erosion of FDR’s New Deal system of government checks and balances on the private monetary and private productive sectors of the U.S. This erosion featured the very policy decisions — a primary example being the repeal of The Glass-Steagall Act under the Clinton administration — that exacerbated the impact of the 2008 Financial Crisis.

All things considered, Keen’s idealistic belief that a highly regulated entrepreneurial-oriented capitalism will be durable, there being no inherent threat of capitalist power creep undermining its smooth functioning, is historically deaf.

Keen’s politics, though, don’t stop short of a further-left position from a tepid social democratic view simply because he’s never read into scholarly traditions offering full-scale alternatives to capitalism. Not at all. In fact, Keen, on brand as the crusading economist pushing for a more rigorous scientific approach to the field, is incredibly well-read on specifically socialistic economic theory (though, it should be mentioned that the almost complete absence of engagement with market socialism, especially given his endless criticisms of demand–constrained command economy socialism, is a bit frustrating).

For example, Keen enthusiastically proclaims during his Lex Fridman podcast appearance that Karl Marx is “probably the most brilliant mind in economics.” Even more surprising is that across the three-and-a-half-hour discussion between himself and Fridman, Marx and Marxism is easily the most discussed subject.

However, in the same podcast appearance, it becomes clear that Keen’s distrust of any form of democratizing the economy and pushing past capitalism comes from his rigorously argued belief that an essential flaw in Marx’s labour theory of value (LTV), as formulated in his 1867 magnum opus, Capital, Volume I. — evidently the subject of Keen’s master’s thesis — brings down all legitimacy of socialist theory and practice.

Keen’s critique of the LTV is complex and goes as follows:

In the first volume of Capital, Keen argues that Marx fails to apply the same standard to machines that he does with labour in terms of the appropriation Marx emphatically ascribes to the gap in labour’s use-value (meaning its value as realized in consumption by human subjects for our needs) over its exchange-value (meaning the value of the commodity expressed in exchange through a comparison with other commodities which uses a mediating figure, number or price, to represent their relative values).

Quickly, an example of the use-value of a banana is that it satisfies the need for nutrition. By contrast, the exchange-value of a banana is found through a ratio-expression of its relative value when compared with other commodities. For example, if a banana costs $1 and two apples cost $1, then one banana is equal to 0.5 apples in terms of exchange-value, and so on.

What Marx argues in Volume I. is that what regulates the exchange-value of commodities is what’s called socially necessary labour time: the average amount of time it takes to produce a commodity under the current productive conditions of society. So, when we see different prices for one apple as opposed to one banana, we aren’t necessarily seeing just that the average subjective preference for the more expensive one is higher than the other, but a more objective measurement of their values in terms of the more expensive fruit taking more average labour time to produce.

From this, Marx argues in the early parts of Capital that because human labour-power is the unique commodity of commodity-production, and given that commodities’ prices are regulated by the average socially necessary labour time in society to produce them, then labour’s exchange-value on the market must be representative of the average socially necessary price needed to maintain labourers, a.k.a. the average cost of subsistence, as that is what’s necessary to ensure the reproduction of the idiosyncratic and essential commodity of labour-power for the capitalist: making products.

However, Marx argues that if labour is the sole commodity-producing commodity, then it follows from these premises that surplus and profit must be a function of using labour-power’s use-value beyond what’s needed to meet the needs of subsistence for the worker.

If all workers only worked (employed the use-value of labour-power) to the point of being able to afford the reproduction of their labour, a.k.a. the costs of subsistence, there would be no such thing as surplus value to create revenue, meaning there would be no profit either. Therefore, the capitalist must make the labourer work beyond the amount of labour time the worker needs to undergo to afford the reproduction of their labour, which again is the exchange-value of labour as expressed by the subsistence wage; the subsistence wage is the average cost of sustaining workers’ needs.

The gap, then, between the labour time the worker needs to work for to meet their substance needs and be able reproduce their labour-power for the next day and the labour they do beyond that to generate revenue for the capitalist, is a problem according to Marx.

What this means, Marx argues, is that when a capitalist is making profits it’s because they’re appropriating this surplus value created by the labourer in the production process. In other words, profit is derived from the capitalist’s exploiting labour-power’s use-value beyond what’s necessary to maintain it in terms of its purchased price/exchange-value in the wage. Profit, then, is stolen wages.

Keen’s refutation of this version of the LTV is that Marx contradicts his own logic by not considering how machines are in a similar position to labour in this whole complex value dialectic.

Machines, like labour, also create commodities, yet Marx says in Volume I. that a machine’s exchange-value is transferred perfectly to the commodity in production through wear and tear with no surplus leftover, thus not being consistent in arguing that there exists a gap between use-value and exchange-value which is deliberately exploited from labour-power by the capitalist.

Moreover, Keen points out that Marx actually pre-empted the insight that use-value and exchange-value are “incommensurable” — one not being able to be derived from the other as the qualitative versus quantitative gap between them could never be bridged — in a footnote of the Grundrisse, which was written years before Volume I.

Keen explains that this pre-Capital insight into the two values’ incommensurability was the basis for Marx to say in Volume I. that labour’s extended use-value beyond its exchange-value is what helps produce surplus, as they can’t be made commensurable anyways.

Yet, Marx’s fatal (intentional?) flaw in Volume I. is that he makes use-value and exchange-value somehow commensurable for machines when he states later in the book that a machine’s use-value in production is perfectly represented in the siphoning of its exchange-value to the commodity as it undergoes wear and tear in producing said commodity. What this assumption means is that there is no gap in use-value and exchange-value for machines, unlike with labour, but the reason why is never explained, as the same problem of there being a gap in use- versus exchange-value should still apply to machines as it does for labour.

Thus, Keen is suspicious about why the same gap in the two values leading to a surplus would not be present for machines as well, considering both labour-power and machine-power are commodity-producing, and their net productive capacities would affect the price of their subsistence needs — the subsistence wage for the former, the costs of purchasing and maintaining the machine for the latter — through socially necessary labour time.

If use-value and exchange-value are incommensurable, this means the same gap must be possible between a machine’s use-value and its exchange-value. And if this is true, that means labour is not the only source of surplus value in contradiction to Marx’s claim that profit is purely labour-appropriated value that the capitalist keeps.

Moreover, if it’s stipulated that machines can produce surplus through being used beyond what their exchange-value is in production, it means labour can be potentially paid the full price of its labour time in a working day if the surplus created by machines is high enough, which negates Marx’s mathematically tractable proof of labour’s exploitation in Volume I.

At one point after Keen’s explanation of this argument on the podcast, Fridman asks Keen what he thinks about “young people proudly calling themselves Marxists.” Keen responds by saying if they don’t understand the exchange- and use-value dialectic and the flaw he exposed in it, then they are “misusing” Marx’s name when identifying with his work.

To be clear, Keen makes a strong critique of the LTV as it’s laid out in the first few chapters of Volume I. However, to expose this flaw in Marx’s logic hardly undermines Marx’s argument that capitalism is a socially destructive and systemically exploitative system based on domination.

Some of the reasons for this are quite simple, while others are more complex.

To begin with, Keen’s criticism does not consider the purely unnecessary role that the capitalist class plays in economic value creation while getting all the spoils of surplus value. Even if machines can create surplus value, being a private owner of capital doesn’t uniquely spur the creation of productive machines, nor does it the intellectual labour of designing them or efficiently implementing them. For the value-form and surplus to arise in a human economy, human labour must have been done at some point, either to produce commodities directly or even indirectly in making the machines that produce commodities. The advent of a capitalist class, however, was never and will never be necessary to the creation of surpluses in our economies, unlike a labouring class which was and is necessary for said surpluses to arise.

Therefore, Keen’s argument in favour of capitalism over socialism due to the flaw in Marx’s theory has to have implicit in it some dubious ad hoc notion of fiduciary or productive responsibility being better attended to when there’s a small class of unelected owners of the means of production who get full discretion over surplus value.

But back to the value argument itself, even if non-human-made energy such as solar energy, which Keen likes to say is ignored by Marxists and neoclassicals alike, is brought into this way of thinking about value in the human economy, the only socially valuable use of energy for human societies is when it is enjoined with human labour in some way to fulfill human needs and desires. And once again, the capitalist — who is simply the legally verified owner of a certain portion of the means of production — plays no essential part in the process of setting the stage for value creation from non-human made value such as solar energy, only human intellectual and active labour can do that.

Indeed, as Marx pointed out the world over in all his major texts, the only class that actuates the appearance of value in a human economy, human workers, are under the unelected rule of a class that is constituted most basically through a legal entitlement to unilateral control of whatever surpluses are created from the labour and labour-derived processes takes place in, on and with their privately owned capital.

Furthermore, as previously mentioned, to the extent a capitalist may come up with ideas that are useful for the production process and creating surplus or machines that can create surpluses, this is still a function of mental or physical labour. Entrepreneurialism doesn’t require private ownership rights, but it does require productive thought and action.

As Marx knew, being a capitalist is simply a social construct reified by legal protections of the right to private productive property backed by the violence of government force. Legitimating private ownership of a part of the means of production is primarily based on a liberal normative structure that is the result of the conflicts born of class struggle throughout history.

Marx’s work demonstrates time and time again that ruling classes throughout history have always been owners in some capacity, whether that’s the master class in ancient times who owned slaves, or lords in the feudal system who lorded over serfs. A corollary to this fact is that it has only been through the grueling work of revolution and reform from the non-owning exploited classes that the ruling classes of past major socio-economic paradigms have slowly had their degree of control and domination over the rest of society attenuated. The work of bottom-up reform and revolution over the last few hundred years has condensed the major ruling classes in human societies to the more temperate — by historical standards — capitalist class of modern day.

Still, when capitalists are preserved as a special class despite having no structural function in value-creation, it leads to socially disastrous outcomes such as extreme wealth and income inequality because the capitalist class is compelled to hold onto their disproportionate share on the communally produced wealth of society in order to compete with other capitalists who have a vested interest in snuffing out their competition for more market share.

Altogether, if one stipulates that Keen’s insight into Marx’s contradiction on the mathematical tractability of the LTV in Volume I. is right, the question of why society should allow a socially disastrous figure like the capitalist to determine how surpluses actuated by labour and labour-made machines are distributed remains unanswered in economics and by Keen — other than in the Marxist tradition that is. This is also why Marxism is not just an economic theory, as Keen would have you believe. Rather the intellectual tradition of Marxism has always been a vibrant inter-disciplinary one in a way that most economic traditions are not.

Keen also too easily dismisses Marxism due to the previously mentioned conflation he makes between capitalism and the entrepreneurial spirit of innovation: “I’m opposed to capitalism parasite-ing [sic] itself, which is what happens when we let the financial sector take over and generate far more debt than we need,” he said during his 2011 appearance on BBC’s HardTalk.

Of course, this idealistic sentiment again fails to see how capitalism inherently parasites itself as Marx and Engels understood when they used the metaphorically powerful, “all that is solid melts into air” refrain in The Communist Manifesto to describe capital’s inherent processes of societal destabilization given that long-term stability is treated as an externality by the short-term focused profit-motive.

As long as human labour is employed in a capitalist economy, Marx’s insights into the psychological and physical suffering — which he spent much ink describing in both highly literary and explicitly literal ways — that capitalism’s undemocratic productive relations in society creates through its entropic movement towards ever-expanding inequality, economic depressions, and undemocratic lording over workers in the workplace makes his critique indispensable to this day.

Said critique is essentially built on understanding how labour stands vis-à-vis value creation and distribution in a capitalist system. In other words, Marx rightly makes central to his analysis labour’s essential place in the production of value and surplus, and how capitalism must necessarily obfuscate this for the enrichment of a small few.

Therefore, Marx’s labour theory of value, Keen’s criticism withstanding, is — as Jacobin contributor Ben Burgis similarly argues — a perennially prescient way of seeing how capitalism is an exploitative and authoritarian system at its core.

Does this mean that Marxists, then, can find the labour theory of value in exact denominations of exploitation expressed in prices as Marx leads us to believe in the first few chapters of Volume I.? The answer is no, and Keen is right to point at this weakness in Volume I.’s formulation of exploitation.

Keen’s overestimation, though, of how damned Marxist and socialist theory is because of his admittedly sharp criticism of Marx’s LTV is due to his failure to think of capitalism’s parasitic qualities as features and not bugs of the system due to his own idealistic hangups.

And this gets to the bone of why Keen unfairly dismisses Marx, which is what’s often the case for economists: bourgeois bias.

This is unfortunate, because as analytically sound and powerful as Keen’s work critiquing neoclassical economic theory is, his own bourgeois repression casts an unavoidable shadow over his successful scholarly fixation on debunking much of mainstream economic theory.

Consequently, when Keen places a majority of the blame for the most urgent economic problems society faces today on the state of mainstream economic theory rather than the problems private capital ownership engenders through its sheer existence being to preserve a self-enriching, dominant class of unelected owners — a class which has a well-documented history of committing financial support to those university departments that pioneered the very capital-partisan economic traditions, notably the neoclassical school, that Keen derides most one should add — his obsession with critiquing mainstream economic theory is hard to not read as involving a fair bit of projection.